springfield mo sales tax on cars

Wayfair Inc affect Missouri. Missouri has a lower state.

Find A Chevy Spark Near Me Vehicle Locator

See reviews photos directions phone numbers and more for Sales Tax locations in Springfield MO.

. University City MO Sales Tax Rate. Home Motor Vehicle Sales Tax Calculator. Springfield MO Sales Tax Rate.

Find the best used cars in Springfield MO. Did South Dakota v. You pay tax on the sale price of the unit less any trade-in or rebate.

You can find more tax rates and allowances for Springfield and Missouri in the 2022 Missouri Tax Tables. Why Buy A Used Car. The 2018 United States Supreme Court decision in South Dakota v.

There is also a local tax of up to 45. In Missouri localities are allowed to collect local sales taxes of up to 090 in addition to the Missouri state sales tax. Springfield in Missouri has a tax rate of 76 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Springfield totaling 337.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. 4 rows How does the Springfield sales tax compare to the rest of MO. Saint Peters MO Sales Tax Rate.

The springfield missouri sales tax rate of 81 applies to the following thirteen zip codes. Missouri has 1090 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. For vehicles that are being rented or leased see see taxation of leases and rentals.

Their website states You must pay the state sales tax AND any local taxes of the city or county where you live not where you purchased the vehicleThe state sales tax rate is 4225 percent and is based on the net purchase price of your vehicle price after rebates and trade-ins. Wentzville MO Sales Tax Rate. 1534 E Kearney St.

I had been to alot of used car places and couldnt find anything that I could afford until I got to. The Springfield sales tax rate is. The reason theres so many expired temp tags is because someone will buy a 30000 car and finance it but then has to pay 2500 in sales tax that must be paid out of pocket.

See the hours of operation for the Regal Car Sales and Credit location in Springfield MO and get driving directions from your. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. The December 2020 total local sales tax rate was also 8100.

Sales Tax City County and State taxes Knoxville TN. Salt Lake City UT. For additional information click on the links below.

There is a 4 percent sales tax imposed by the state. Higher sales tax than 62. Springfield MO Sales Tax Rate The current total local sales tax rate in Springfield MO is 8100.

The maximum tax that can be charged is 725 dollars on the purchase of all vehicles. The Missouri sales tax rate is currently. Has impacted many state nexus laws and sales tax collection requirements.

This makes sense because people can include the sales tax in the loan. Best car buying experience and great price. Wichita Falls TX.

The Missouri DOR is the agency authorized to assess and collect the monies. The local sales tax to be collected on the purchase price of motor vehicles trailers watercraft and motors at the time application is made for title if the address of the applicant is within a city or county listed below. Subtract these values if any from the sale.

Rates include state county and city taxes. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355. New Car Dealers Used Car Dealers.

12102021 motor vehicle bureau motor vehicle sales tax rate chart updated 12102021 16250 17000 22000 to be used for the months of january february march 2022 the local sales tax to be. America S Car Mart Home Facebook The maximum tax that can be charged is 725 dollars on the purchase of all vehicles. The Springfield sales tax rate is 213.

Missouri collects a 4225 state sales tax rate on the purchase of all vehicles. The springfield missouri sales tax rate of 81 applies to the following thirteen zip codes. The latest sales tax rates for cities in Missouri MO state.

According to the Sales Tax Handbook the state of Missouri imposes a 4225 percent state general sales tax rate on the purchase of. Fort Wayne IN 700. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Columbia SC 700. The County sales tax rate is.

Evansville IN 700. Motor vehicle titling and registration. This rate is in addition to the state tax.

2020 rates included for use while preparing your income tax deduction.

Five Ways Car Shoppers Are Responding To Record Low Inventory

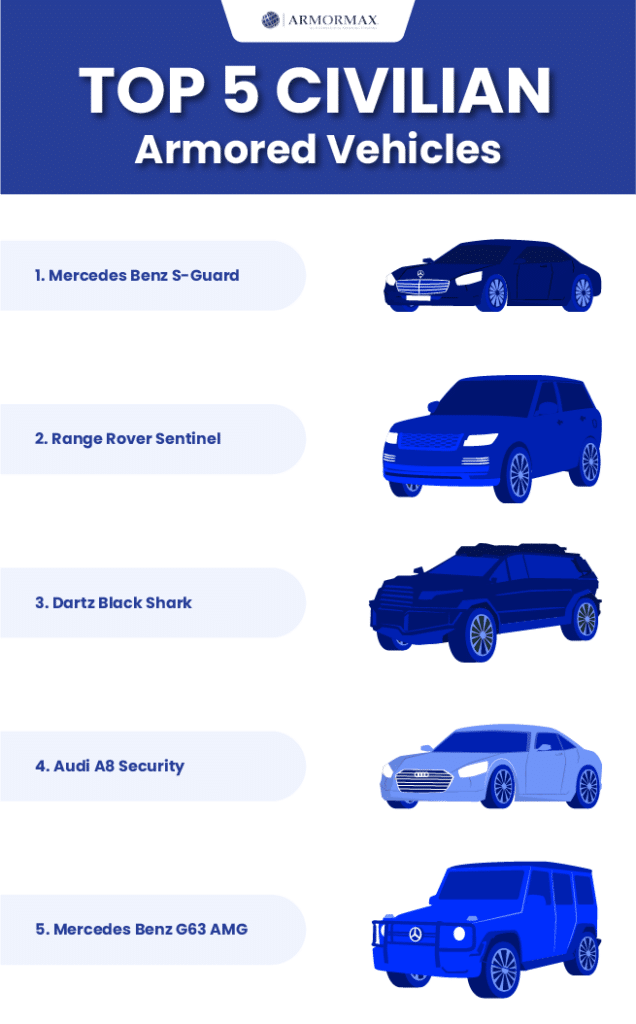

How To Buy An Armored Vehicle As A Civilian Armormax

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Learn More About Enterprise Certified Used Cars Enterprise Rent A Car

Used Cars Under 9 000 For Sale Vehicle Pricing Info Edmunds

Should I Buy Or Lease A Car Now 2021

Best Used Subcompact Cars For 2022 Ranked Carmax

What S A Good Apr For A Car Loan Find Out Now Br Telco Federal Credit Union

How To Get A Decent Car For 1000 Or Less

Bmw 740il Car Fi Springfield Mo Car Stereo Car Audio Systems Car Audio

Should I Sell My Car For Parts Credit Karma

Are Car Repairs Tax Deductible H R Block

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Campbell River Used Car Dealership Pacific Nations

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Buy An Armored Vehicle As A Civilian Armormax

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price